- Research

- Open access

- Published:

Public debt dynamics: the interaction with national income and fiscal policy

Journal of Economic Structures volume 10, Article number: 8 (2021)

Abstract

The 2008 financial crisis triggered the debt crisis in Europe. High debt-to-GDP ratios made it impossible for some countries to apply countercyclical policy in order to overcome the recession. As a result, highly indebted countries were forced to apply austerity measures to avoid sovereign default, which deepened even further the decline of their GDP. We examine the case of a highly indebted country, which is not cut off from the financial markets yet, using a bilinear difference equation system. We contemplate the dynamic equations of national income and sovereign debt together, as GDP fluctuations directly affect the debt evolution and we introduce the notion of the second relation, namely the deceleration of private investments due to sovereign debt. We build a new method for the implementation of fiscal policy, a feedback control of the economic system, and we stress its consequent policy implications. We contribute to the existing debt dynamics literature providing a new perspective for the interaction of public debt and GDP. The fiscal policy method we propose vanishes the dilemma between the front-loaded and back-loaded austerity, combines the fiscal recovery from a recession and the fiscal consolidation, as it immediately improves the debt-to-GDP ratio by increasing the national income and restraining the rise of public debt. Finally, we stress why the second relation is important for the implementation of fiscal policy, as its presence leads to a slower and more painful recovery.

1 Introduction

The period of Great Moderation ended with the 2008 financial crisis, which made economists to set in question the tenets that they have been following since then (Blanchard et al. 2010). This reassessment was important because the 2008 crisis was different than previous ones; it was global, more severe and incurred at least one more crisis, that of debt sustainability and sovereign default (Romer 2012). In Europe, five countries initially (Greece, Italy, Ireland, Portugal and Spain) and then Cyprus faced severe problems with their sovereign debt and were forced to apply consolidation measures in order to restrain their deficits and lower their debt-to-GDP ratio at sustainable levels. For the rescue of the countries mentioned above, except Italy and Spain, consolidation programs were formed by the ESM, ECB and the IMF.

Consequently, research was focused on the debt-to-GDP ratio dynamics and its relation with other variables (such as interest rates, primary surpluses and GDP growth rate) in order to be investigated whether the debt-to-GDP ratio will remain at sustainable levels or not. Escolano (2010), Genberg and Sulstarova (2008), Casadio et al. (2012) and Berti et al. (2013) are examples of research on debt-to-GDP ratio dynamics. However, despite the research on the interaction of the above variables with the debt-to-GDP ratio, there are not to our knowledge any research that explicitly combines the debt evolution with national income dynamics and examines them as a system, employing the framework we use.Footnote 1

Before 2008Footnote 2 fiscal policy was abandoned for several reasons, being among them the following three: fiscal policy can stimulate national income only after some lags; if monetary policy can achieve the smallest output gap then fiscal policy is not needed any more; third, Ricardian equivalence had set in question its efficacy. However, the crisis put forth again its importance as policy instrument to overcome a recession. Romer (2012) stresses that fiscal policy has great effects even in the short-run. Blanchard et al. (2010) points that, having no other means for expansionary policy, given the zero lower bound of policy rate, fiscal space is vital and improved fiscal policy methods, such as fiscal stabilizers, must be built on.

Another aspect of the debt crisis was that it created an intellectual dispute about whether the needed austerity should be front or back loaded and, even more, if austerity is contractionary or expansionary. The first part of this dispute sets the question: should a highly indebted country conduct contractionary policy to limit the budget deficits or expansionary policy, together with commitment for future fiscal discipline, to overcome the recession? The front-loaded austerity is needed to avoid sovereign default but deepens the recession. The back-loaded austerity helps to overcome the recession, but increases the debt-to-GDP ratio. Berti et al. (2013) support the front-loaded austerity, as they stress that even though in the short-run debt-to-GDP ratio rises, in the long-run it returns to sustainable levels, while Romer (2012) supports the back-loaded austerity, as the commitment for future fiscal discipline is enough to calm financial markets. Regarding the second part of this dispute, Alesina and Ardagna (2010), Alesina et al. (2018) and Alesina et al. (2019) supports that austerity based on spending cuts is less likely to create a recession than that based on tax increases. They even document a few episodes of expansionary fiscal adjustments, such as that of Ireland, Denmark, Belgium and Sweden in the 1980s and Canada in the 1990s. On the other hand, Romer (2011) disagrees and supports that expansionary and contractionary fiscal measures has great effects and these effects are to the expected direction. In fact, this aspect of the dispute reveals the debate about the efficacy of the two fiscal policy instruments, spending and taxes, and which one to utilize. Romer (2011) supports that spending is always more effective than taxes, despite applying expansionary or contractionary measures. On the other hand, Alesina and Ardagna (2010) support that taxes are more effective than spending.

Our study adds to the existing literature because it (a) stresses the importance of fiscal policy; (b) proves the necessity of the simultaneous usage of both taxes and government outlays; (c) vanishes the dilemma of front-loaded or back-loaded austerity; (d) introduces the notion of second relation, namely the deceleration of private investments due to sovereign debt, and (e) explicitly and discretely examines the national income and debt dynamics in order to provide answers regarding the fiscal consolidation of a country.

2 Methods

The aim of this paper is to propose a new fiscal policy method, namely a feedback control of the economic system, which exploits the two available controllers, the government outlays and the aggregate tax rate. This theoretic approach for the implementation of fiscal policy is based on the interaction of GDP with sovereign debt, as we contemplate their dynamic behavior together as a system. The method we develop produces flexible policy rules, which depend on pre-specified targets for national income and sovereign debt and also on their previous values. For every period t, the policy-maker sets the targets and then adjusts the government expenditures and the aggregate tax rate according to the policy rule to exactly meet these targets. We also exploit the same method of feedback control to produce policy rules, but now the target of sovereign debt turns into target for the primary surplus. This second approach is much closer to the rescue programs that were formed for the countries of southern Europe, as the policy-maker can fix specific targets for the primary surplus.

The model we use is a form of the discrete time multiplier-accelerator model, that was firstly proposed by Samuelson (1939) and then was adopted by a great number of economists, such as Hicks (1950), Hommes (1993), Hommes (1995), Kotsios and Leventidis (2004), Puu et al. (2005), Puu (2007), Sushko et al. (2010), Westerhoff (2006a), Westerhoff (2006b), Westerhoff (2006c), Dassios et al. (2014), Kostarakos and Kotsios (2017) and Kostarakos and Kotsios (2018). Specifically, it is a deterministic discrete time bilinear system of difference equations, which has two dynamic equations, for the national income and the sovereign debt. Bilinear systems have a special type of non-linearity; there is at least one input which is multiplied with the state vector. Thus, the system we propose has two controllers, the additive one, which is the government outlays, and the multiplicative one, which is the aggregate tax rate.

3 Results

The results presented here indicate that a highly indebted country can overcome a recession and simultaneously decrease its debt-to-GDP ratio by activating the proposed feedback control method. Thus, the dilemma of front-loaded or back-loaded austerity vanishes, as the proposed method manages to achieve the needed fiscal adjustment and to increase national income. The proposed control method produces flexible rules for the determination of the government outlays and the aggregate tax rate, which are dependent to desirable targets and to the previous values of the state vector. This result explicitly suggests that both policy instruments, taxes and spending, have to be employed in order to meet the two targets, income–debt or income–primary surplus, despite the vast debate about which of them to use and about their efficacy. This result is in contrast with Romer (2011) and Alesina and Ardagna (2010) who propose the utilization of only one instrument, spending. Romer (2011) proposes spending increases to avoid recession, though being aware that the level of debt or that of primary deficit cannot be predetermined, and Alesina and Ardagna (2010) who propose spending cuts to achieve fiscal adjustment only. Our results are similar to Elmendorf and Sheiner (2017) suggestion to enact a combination of increased public investments and tax raises. However, in addition to the intuition of Elmendorf and Sheiner (2017), our model provides a more concrete method for the implementation of fiscal policy, as pre-specified targets can be met.

The remainder of this paper is organized as follows: in Sect. 2 we build the model, in Sect. 3 we state the policy problem and we build the method for the implementation of fiscal policy which can be used by a highly indebted country, in Sect. 4 we contemplate the stability of tax rate’s path and the consequent policy implications, in Sect. 5 we compare the policy rule for taxes with the conducted tax-policy of several countries, in Sect. 6 we conduct policy experiments and in Sect. 7 we conclude.

4 The model

The total output of the economy is equal to the sum of consumption, investment and government outlays, the income identity for a closed economy. The consumption function embodies the Keynesian notion of the multiplier and it is equal to the propensity to consume multiplied by the disposable income that agents earned the previous period. However, following Hommes (1993), we distribute consumption in three lags, so agents’ consumption function is affected by the disposable income of the three previous years, which is multiplied by the partial consumption coefficients. So, the consumption function is:

where

s1, s2, s3: partial consumption coefficients, where 0 < si < 1, i = 1, 2, 3

Ydt = Yt − τtYt the disposable income.

τt: the aggregate tax rate, where 0 ≤ τt−i ≤ 1, for all t.

For the partial coefficients s1, s2 and s3, we again follow Hommes (1993); thus their sum is less than unity, s1 + s2 + s3 < 1 and s1 > s2 > s3 > 0. The above assumptions state that the consumption cannot exceed the income earned and that the highest and lowest fraction of income are spent with a delay of one period and with a delay of three periods, respectively, where the second assumption “…seems to be the most relevant from an economic point of view.” Hommes (1995, p. 447). The aggregate tax rate τ represents the total tax revenue-to-GDP ratio, namely the portion of GDP that the government collects as revenue. This desired tax revenue can be achieved by all the means that a government has at hand, direct and indirect taxes and social contributions as well.

The investment function embodies the acceleration principle, the so-called relation, which many economists have used since 1930s, starting from Frisch (1933), Samuelson (1939), Hicks (1950) and Goodwin (1951). The acceleration principle states that the discrepancy between the income of the two previous periods induces agents to form their behavior about their investment decisions. Thus, induced investment is proportional to this discrepancy, multiplied by the accelerator coefficient v.

Since the two influential paper of Reinhart and Rogoff (2010) and Reinhart et al. (2012), the public debt overhang theory has become a major issue of the literature. Debt overhang deals with the slowdown of income growth rate that is brought on by public debt. An example of debt overhang literature is Kumar and Woo (2010), who find a negative relation between initial public debt-to-GDP ratio and subsequent real per capita income growth using a panel of 38 countries from 1970 to 2008. This negative effect is due to a slowdown in labor productivity, which in turn is because of reduced investment. Similarly, Ewaida (2017) finds a negative impact of public debt-to-GDP ratio on economic growth, which is statistically significant after the debt-to-GDP ratio becomes greater than 90%, and one of the most affecting channels is savings/investments. In a more specific research, Salotti and Trecroci (2016), using a panel data set for twenty OECD countries from 1970 to 2009, estimate the effect of debt on aggregate investment and productivity growth. They find a statistically significant negative effect of debt-to-GDP ratio on investments’ growth rate, with no evidence of non-linear relationship between the two variables. Aggregate investment is composed by two parts, public and private investment, with the latter being composed by corporate and household investment. Bacchiocchi et al. (2011) find that high debt-to-GDP ratio reduces government capital expenditure in all OECD countries. However, public expenditures will not concern us, as in our model they are embodied in government outlays G. Moreover, Graham et al. (2014), using micro-dataset of accounting and market information for the most publicly traded non-financial firms in the US, found that the sovereign debt is strongly negatively correlated with corporate debt and investment. Namely, when a sovereign debt is high, there is a plethora of sovereign bonds that an investor can buy, which are safer, so firms change their behavior and do not issue corporate bonds to finance their investment decisions. Thus, a high sovereign debt changes firms’ behavior and affect negatively the demand for investment. As Furth (2013) mentions, “…when savings are invested in government bonds, they cannot also be invested in productive capital”, thus private investment is crowded out by public debt. So, it is apparent that the debt-to-GDP ratio affects the income growth rate through the private investment growth rate. However, as we mentioned above, this crowd-out effect exists because of the fact that high debt deprives money from investors who want to invest. This effect has to do with a quantity of money that goes to government bonds and not to finance investments. Thus, we make the reasonable assumption that the stock of debt affects the level of private investment, an aspect that we name second relation and we embody it to the investment function. Following the same reasoning, we assume that the consequence of buying government bonds in the current period will be obvious in the next period, when investors will not be able to raise funding for their investment plans. Thus, public debt is embodied with a lag in the investment function. Thus, the investment function is:

where Iaut is the autonomous investment, which is consider to be constant; v is the accelerator coefficient, where v > 0; a is the decelerator coefficient, where a > 0, and Bt is the current level of sovereign debt.

The national income can now be expressed in the following identity:

where Yt is the current national income; Gt are the current government outlays; substituting the behavior equation of consumption and investment into (3) national income becomes:

where c1,t = s1(1 − τt−1) + v,

c2,t = s2(1 − τt−2) – v,

c3,t = s3(1 − τt−3).

The debt dynamics are described by the usual difference equation:

where r is the interest rate of debt which we consider as constant. The system has two elements exogenously determined by the policy-maker, the government outlays Gt and the aggregate tax rate τt, namely the two controllers, the additive and the multiplicative, respectively. Equations (4) and (5) constitute the system of difference equations under consideration. It is an autonomous bilinear inhomogeneous difference equations system of third degree.

5 Fiscal policy under flexible rules

The method we propose is a sort of feedback control which takes advantage of both the controllers of the bilinear system (4)–(5), the aggregate tax rate and the government outlays. However, the policy-maker defines the aggregate tax rate τt at period t and it will affect the system only at the next period t + 1 and then for two more periods. The problem under consideration is:

5.1 Economic problem

Let T be a fixed and given time instant. Define a pair of controllers Gt, t = t1, t2, …, T and τt, t = t1, t2, …, T − 1 such that, the state vector (Yt, Bt) will coincide with a predetermined trajectory (Y∗t1, B∗t1), (Y∗t2, B∗t2), …, (Y∗T, B∗T) at the time instants t = t2, t3, …, T, that is: (Yt2, Bt2) = (Y∗t2, B∗t2),(Yt3, Bt3) = (Yt3, Bt3), …,(YT, BT) = (Y∗T, B∗T).

5.2 Control method

Before we state a theorem that solves the above economic problem, it is crucial to clarify the time that the policy maker is able to define the two controllers and the time that these controllers will affect the economic system. Suppose that t = 0. The policy-maker can define G0 and τ0. The government outlays G0 will affect the income and debt of period t = 0, (Y0, B0), while τ0 will affect the (Y1, B1). Suppose now that at the middle of period t = 0, a government decides to run a consolidation program. G0 and τ0 are already set. Since system (4)–(5) is deterministic, the policy maker can easily compute the vector (Y0, B0). In order the policy maker to compute (Y1, B1), he must only define G1, as the τ0 has already been set. Thus, the policy maker can completely predetermine either Y1 or B1, as he has at hand only one controller, the government outlays. In contrast, when the period t = 1 starts and G1 has been set, the policy maker has at hand both controllers G2 and τ1 and he can completely predetermine the vector (Y2, B2). The same is valid till t = T, when the termination of the consolidation program is decided.

Theorem 3.1.1.

Let the policy-maker has at hand the two controllers, the government outlays and the aggregate tax rate, at the time instant t = k. If the targets for national income and for sovereign debt are (Y∗k+1, B∗k+1), then the next unique values for Gk+1 and τk:

match them. That is, Yk+1 = Y∗k+1 and Bk+1 = B∗k+1 for t = k + 1, whenever (G∗k+1, τ∗k) have been applied to the system (4)–(5).

Theorem 3.1.1Footnote 3 states that the system (4)–(5) can be forced to follow a predetermined trajectory. The pair of functions (G∗k+1, τ∗k) of the above theorem is a constant rule for the implementation of fiscal policy. If k successive targets for income and debt have been set, then the policy-maker must compute k values for the government outlays and the aggregate tax rate. These k values of the government outlays and the aggregate tax rate will be applied to the system at k successive periods and k pairs of the targets will be matched. For example, let k = 2 and the trajectory of the targets is ((Y∗3, B∗3),(Y∗4, B∗4)). Then the policy-maker must compute according to the rule of Theorem 3.1.1 the two pairs of instruments (G∗3, τ∗2) and (G∗4, τ∗3) and then apply them to the system (4)–(5) in two successive periods t = 3, 4 to match the targets. Theorem 3.1.1 also states the efficiency of the proposed control method.

The economic problem as defined above and its solution through Theorem 3.1.1 have two important implications. The first one has to do with the notion of controllability. The above economic problem is a problem of perfect output controllability (Aoki 1975). This means that, in order the problem to be solved, at least two instruments are needed. So, if a policy maker wants to adjust the debt-to-GDP ratio, namely to influence two variables (income and debt), he has to exploit both the government spending and the aggregate tax rate. This implication lessens the importance of the dispute about which policy instrument to use, taxes or spending, as both are needed. Second, Theorem 3.1.1 provides a rule of how the policy maker should implement fiscal policy by using the two instruments. This rule implies an important result that is summarized in the Corollary below.

Corollary 3.1.1.

The aggregate tax rate and the government outlays which are defined by the rule of Theorem 3.1.1 will exhibit similar dynamic behavior, as their difference equations have the same independent variables and their coefficients have the same sign.

The proposed control method will lead to a mix of expansionary and contractionary policy because the aggregate tax rate and the government outlays either will increase together or they will decrease together following similar trajectories.

5.3 Flexible policy rules

In applied policy, it is important to set and achieve stable targets for the income growth rate, the evolution of sovereign debt and the primary surplus. Besides, the rescue programs in Europe, at least in Greece, were built in that sense, where governments were committed to achieve specific targets for their primary surpluses. As stated above, the rules of Theorem 3.1.1 guarantee perfect output controllability of system (4)–(5). Thus, the policy maker can choose two target trajectories, for income and debt, respectively, according to desired growth rates for the two variables.

We distinguish two different cases. According to the first, the national income and the sovereign debt are forced to grow at a predetermined rate. According to the second, national income is forced to grow at a certain growth rate and the primary surplus is fixed to a constant percentage of GDP, which is a slightly different method. The second approach will be analyzed in the next section.

Case 1: The constant growth rate of income and debt

where d1 and d2 are the constant rates for income and debt, respectively.

Substituting the above relations into the equations of Theorem 3.1.1, Gt+1 and τt become:

Lemma 3.2.1.

Exploiting even further the equations Yt+1 = (1 + d1)Yt and Bt+1 = (1 + d2)Bt and rearranging, Eq. (7) can be written as follows:

where

and

\(\frac{{B_{t} }}{{Y_{t} }} = \left( {\frac{{1 + d_{2} }}{{1 + d_{1} }}} \right)^{{t - 1}} \frac{{B_{1} }}{{Y_{1} }}\;{\text{and}}\;\frac{{I^{{{\text{aut}}}} }}{{(1 - s_{1} )Y_{t} }} = \frac{{I^{{{\text{aut}}}} }}{{(1 - s_{1} )(1 + d_{1} )^{{t - 1}} Y_{1} }},\;t \ge 1.\)

Defining fiscal consolidation to be the reduction of the debt-to-GDP ratio, namely that the income growth rate is higher than that of debt, while d1 > 0, we can put forward to the following theorem.

Theorem 3.2.1.

FiscalFootnote 4 consolidation guarantees that the tax rate which is defined according Eq. (8) will not diverge to infinity.

Corollary 3.2.1.

Given Theorem (3.2.1), if there is a time span t = 1…,k where the input P of Eq. (8) is non-positive, then the tax trajectory will be declining. Equivalently, the equation below must hold:

If the input P is positive, then the lower its magnitude, the smoother the upward slope of the tax trajectory will be.

Corollary 3.2.1 stresses the conditions under which the proposed method can be better utilized and be applied for greater period of time. In the next section, we will interpret its consequences.

5.4 Fixed primary surplus

Case 2: The constant growth rate of income and the primary surplus as a constant percentage of GDP

where d1 is the constant income growth rate and d3 the constant percentage of primary surplus.

Case 2 consists a slightly different version of case 1. Now, we have a target for the national income and we do not consider the evolution of public debt. However, by fixing the primary surplus we can compute the government outlays Gt+1 and the aggregate tax rate τt that control the system (4)–(5). If we directly solve the system Y∗k+1 = (1 + d1)Yk and τkYk − Gk+1 = d3Y∗k+1, the second case produces the following fiscal policy rules:

Using Y∗t+1 = (1 + d1)Yt and substituting it into the above equations, we get for Gt+1 and τt:

Lemma 3.3.1.

Exploiting even further the equations Yt+1 = (1 + d1)Yt and τtYt − Gt+1 = d3Yt+1 and rearranging, Eq. (11) can be written as follows:

where \(Q = \frac{{(1 + d_{3} )(1 + d_{1} )^{3} - (v + s_{1} )(1 + d_{1} )^{2} + (v - s_{2} )(1 + d_{1} ) - s_{3} }}{{(1 - s_{1} )(1 + d_{1} )^{2} }} + \frac{a}{{1 - s_{1} }}\frac{{B_{t} }}{{Y_{t} }} - \frac{{I^{{{\text{aut}}}} }}{{(1 - s_{1} )Y_{t} }},\)

and

Theorem 3.3.1.

FiscalFootnote 5 consolidation guarantees that the tax rate which is defined according Eq. (12) will not diverge to infinity.

Corollary 3.3.1.

Given Theorem (3.3.1), if there is a time span t = 1,…,k where the input Q of Eq. (12) is non-positive, then the tax trajectory will be declining. Equivalently, the equation below must hold:

If the input Q is positive, then the lower its magnitude, the smoother the upward slope of the tax trajectory will be.

Similarly with Corollary (3.2.1), Corollary (3.3.1) stresses the conditions under which this version of the method can be used. We will discuss its consequences in the next section.

6 Remarks about fiscal policy

The two cases analyzed above produce an aggregate tax rate trajectory according to the difference Eqs. (8) and (12), respectively. Each term of relations (9) and (13) reveals the impact that incurs to the tax trajectory depending on its coefficient sign. The policy-maker can reach valuable conclusions by Eqs. (9) and (13) in order to plan and execute fiscal intervention following the rules of Case 1 and Case 2. The following remarks concentrate these conclusions.

6.1 Remark No1: the impact of consumption

In both cases the term \(- (s_{1} + \frac{{s_{2} }}{{1 + d_{1} }} + \frac{{s_{3} }}{{(1 + d_{1} )^{2} }})\) reveals the impact of consumption to the aggregate tax rate. If s1 + s2 + s3 → 1, then the aggregate tax rate will follow a lower trajectory, thus the tax burden of the consolidation will be mild. Alternatively, the policy-maker could set a greater growth rate for income d1 with the same tax cost.

6.2 Remark No2: the impact of the initial fiscal conditions upon consolidation efforts

The resulting aggregate tax rate from both cases depends on the initial condition of the economy, concerning the debt-to-GDP ratio \(\frac{{B_{1} }}{{Y_{1} }} = b_{1}\), as it affects positively the inputs P and Q. Thus, starting the reform with a higher debt-to-GDP ratio means heavier tax burden. Setting d2 > r + a for Case 1 consists the sole exception. However, this case implies that the country will run primary deficits rather than primary surpluses, which constitutes deficit-financed expansion and not consolidation. We should mention here, that this remark has nothing to do with the dilemma of front-loaded or back-loaded austerity, as the proposed method guarantees immediate recovery for income. It only states that starting the consolidation with worse initial conditions, you will have to pay a heavier tax burden.

6.3 Remark No3: the importance of private sector

This remark underlines the importance of the private sector of the economy. High enough autonomous investments and accelerator v guarantee a lower aggregate tax rate trajectory. Again, the policy maker can take advantage the increased autonomous investments and the increased accelerator to achieve better targets for income and debt growth rates or higher primary surpluses for Case 2.

6.4 Remark No4: the impact of a and r

For both cases, the second relation a increases the input P and Q and, so, it makes fiscal adjustment harder. This means that given a high enough a the aggregate tax rate will be higher and the policy maker will not be able to achieve a quick and painless fiscal adjustment. The same is true for the interest rate, as it has the same influence on inputs P and Q.

7 Policy rule for taxes and an example of fiscal consolidation

The aggregate tax rate of the proposed method needs to be adjusted every period in order the policy maker to meet the pre-specified targets and such a policy may confuse the economy of a country. However, when fiscal consolidation consists the first priority, changing the aggregate tax rate may be well justified. For example, the last decade was characterized by severe fiscal adjustments and reforms, especially in Europe, as the Great Recession made many countries to apply austerity measures. These measures included several tax increments, where the most severe of them were imposed in Greece, which was about to default in 2010. However, most countries in Europe increased the tax revenue-to-GDP ratio in order to fight existing or future deficit problems. This is depicted in Table 1, which contains data for the countries of the European Union after 2006 and till 2018.Footnote 6

The first conclusion from Table 1 is that between 2009 (the year that the Great Recession made its impact apparent) and 2018 only five countries decreased their tax revenue-to-GDP ratios (Esthonia, Ireland, Hungary, Malta and Norway) and by less than 2%. The biggest increase was made by Greece, Iceland, Slovakia, Portugal, Spain, France and Poland. The increase was 8.1, 5.6, 5.3, 5.1, 5.0, 4.3 and 4 percentage points of their GDP, respectively. These examples are thoroughly compatible with are model, as the adjustments were made year by year.

8 Policy experiments

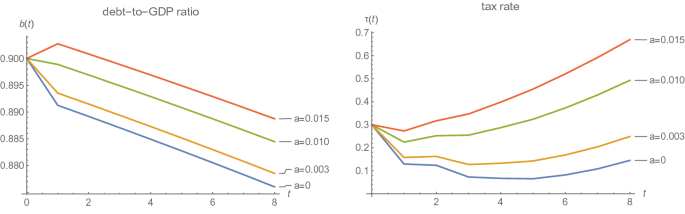

In this section several simulations are presented which concern the way that the parameters of the fiscal rules affect the aggregate tax rate and the debt-to-GDP ratio. Appendix C contains a table which depicts the values of these parameters for all simulations. In each simulation a single parameter takes four different values and the corresponding figure (first simulation corresponds to Fig. 1, etc.) depicts the resulting trajectories of the aggregate tax rate and the debt-to-GDP ratio. The blank cells of the table in Appendix C point the parameter that takes different values and the cells that contain a dash point the parameter that is not applicable to the specific simulation, according to the method followed. Simulations for Case 1 of Sect. 3.2 are depicted in Figs. 1, 2, 3, 4, 5, 6 and 7 and simulations for Case 2 of Sect. 3.3 are depicted in Figs. 8, 9, 10, 11, 12, 13 and 14, respectively. Regarding the parameters that take different values, we chose s1 + s2 + s3 ≈ 1 and s1 > s2 > s3 for the partial consumption coefficients, supposing that previous values of national income plays a decreasing role in the total consumption. For the income growth rate d1, the debt growth rate d2 and the percentage of primary surplus d3 we chose a range from 1.5 to 5%. For the interest rate we chose a range from 3 to 6%. For the accelerator v the selected range is (0.15−0.25) and for the second relation a is (0.3−1.5%). The initial conditions for all simulations are 90% debt-to-GDP ratio, 30% aggregate tax rate and public spending 30% of GDP. Finally, autonomous investments are constant and equal to 7% of the initial national income. Thus, an adequate and economically sensible range for all the parameters is selected in order to examine the qualitative behavior of the model.

8.1 Simulations for Case 1

Simulations presented here concerns the policy rules of Sect. 3.2. Figures 1, 2, 3, 4, 5, 6, 7 depict the way that the aggregate tax rate and the debt-to-GDP ratio are affected by different values of a single parameter. All figures show that the aggregate tax rate and the debt-to-GDP ratio are affected as is stressed in Sect. 4. Figure 4 shows that 1% change in the interest causes enormous shifts at the aggregate tax rate trajectory. However, simulation here depicts a negative value for the aggregate tax rate. This can be avoided by the policy maker simply by revising his targets for d1 and d2. Figure 5 points out that if the policy maker defines a high value for d1, he will succeed a quicker consolidation but the economy will suffer a heavier tax burden. Similarly, Fig. 6 depicts that a lower debt growth rate d2 can be interpreted in the same manner as before. Finally, Fig. 7 depicts that a more sensible target for income growth d1, which is defined at 1%, mitigate the tax burden, as it can be compared with Fig. 3.

8.2 Simulations for Case 2

In the present section, we show the simulations which are according to the policy rules of Sect. 3.3. Figures 8, 9, 10, 11, 12, 13, 14, similarly with the previous simulations, depict the way that the aggregate tax rate and the debt-to-GDP ratio are affected by different values of a sole parameter. Again, all figures show that the aggregate tax rate and the debt-to-GDP ratio are affected as is stressed in Sect. 4. In Fig. 9, the aggregate tax rate drops below zero due to rather extreme values of the accelerator. It is apparent that if this is case, the policy maker can easily improve his targets for income growth or primary surplus and achieve a quicker consolidation. Moreover, this case reveals the great importance of the accelerator, as little changes in its magnitude incur grave shifts in the debt-to-GDP ratio and the aggregate tax rate trajectories. Figure 10 points out the importance of the second relation. Minor changes in its value also bring great changes in the aggregate tax rate and the debt-to-GDP ratio. Figure 12 has the same interpretation with Fig. 5. Figure 13 points out that if the policy maker defines a high value for d3, the tax burden will be higher but the adjustment will be faster. Figure 14 shows that a lower target for d1 lowers the trajectory of the aggregate tax rate lightening the tax burden, as it can be compared with Fig. 10.

9 Concluding remarks

Combining the dynamics of national income with that of sovereign debt, our aim was to develop a new method for the implementation of fiscal policy, which satisfies simultaneously the fiscal recovery and consolidation. The results presented in this paper prove that the economic system can be successfully controlled as we developed a new method for the definition of the tax rate and the government outlays, which forces national income and sovereign debt to follow pre-specified trajectories. Our method produces flexible rules that a policy maker can use to meet his fiscal targets of national income and sovereign debt growth rates, and of the percentage of primary surplus. Our results indicate that the fiscal recovery accompanied with fiscal consolidation is attainable. In addition, they indicate that there is a trade-off between the magnitude of the tax rate, namely how painful a consolidation is, with the length (or speed) of the consolidation. Thus the policy-maker can choose between a fast and painful fiscal adjustment and a slow and less painful one. Nevertheless, our results make the dilemma of front-loaded or back-loaded austerity to vanish. Another important conclusion is that both the tax rate and the public spending are needed in order to adjust the debt-to-GDP ratio and our model suggests that they will follow similar trajectories, either upward or downward. Furthermore, we show that the private sector of an economy is of major importance, as private investments can make recovery and consolidation faster and less painful. Finally, we introduce the notion of the second relation, the deceleration that sovereign debt causes to private investments, and we stress its importance in the design of fiscal policy.

Availability of data and materials

Not applicable.

Notes

For a comprehensive analysis, see Blanchard et al. (2010).

For the proof of Theorem 3.1.1, see Appendix A.

For the proof of Theorem 3.2.1., see Appendix B.

For the proof of Theorem (3.3.1), see Appendix B.

Data are retrieved from the annual report “Taxation trends in the European Union” of the European Commission of the years 2008 to 2020.

Elaydi (2004, p.252).

References

Alesina A, Ardagna S (2010) Large changes in fiscal policy: taxes versus spending. Tax Policy Econ 24(1):35–68

Alesina A, Favero CA, Giavazzi F (2018) What do we know about the effects of austerity? AEA Papers Proc 108:524–530

Alesina A, Favero C, Giavazzi F (2019) Effects of austerity: expenditure-and tax-based approaches. J Econ Perspect 33(2):141–162

Aoki M (1975) On a generalization of Tinbergen’s condition in the theory of policy to dynamic models. Rev Econ Stud 42(2):293–296

Bacchiocchi E, Borghi E, Missale A (2011) Public investment under fiscal constraints. Fisc Stud 32(1):11–42

Berti K, De Castro F, Salto M et al (2013) Effects of fiscal consolidation envisaged in the 2013 stability and convergence programmes on public debt dynamics in eu member states, Technical report, Directorate General Economic and Financial Affairs (DG ECFIN), European Commission

Bhattarai K, Trzeciakiewicz D (2017) Macroeconomic impacts of fiscal policy shocks in the UK: a DSGE analysis. Econ Model 61:321–338

Blanchard O, DellAriccia G, Mauro P (2010) Rethinking macroeconomic policy. J Money Credit Bank 42(s1):199–215

Brand T, Langot F (2018) Which fiscal rule for france? Lessons for the DSGE model of cepremap, Focus du CAE (24-2018)

Casadio P, Paradiso A, Rao BB (2012) The dynamics of Italian public debt: alternative paths for fiscal consolidation. Appl Econ Lett 19(7):635–639

Castro G, Félix RM, Júlio P, Maria JR (2015) Unpleasant debt dynamics: can fiscal consolidations raise debt ratios? J Macroecon 44:276–294

Dassios IK, Zimbidis AA, Kontzalis CP (2014) The delay effect in a stochastic multiplier-accelerator model. J Econ Struct. https://doi.org/10.1186/s40008-014-0007-y

Elaydi S (2004) An introduction to difference equations. Springer, Berlin

Elmendorf DW, Sheiner LM (2017) Federal budget policy with an aging population and persistently low interest rates. J Econ Perspect 31(3):175–194

Escolano J, Escolano J (2010) A practical guide to public debt dynamics, fiscal sustainability, and cyclical adjustment of budgetary aggregates (No. 2010/002). International Monetary Fund, Washington, DC

Ewaida HYM (2017) The impact of sovereign debt on growth: an empirical study on GIIPS versus JUUSD Countries. Eur Res Stud J XX(2A):607–633

Frisch R (1933) Propagation problems and impulse problems in dynamic economics. In: Economic Essays in Honour of Gustav Cassel. George Allen and Unwin, Londo

Furth S (2013) High debt is a real drag. Herit Found Issue Brief 3859:1–3

Genberg H, Sulstarova A (2008) Macroeconomic volatility, debt dynamics, and sovereign interest rate spreads. J Int Money Financ 27(1):26–39

Goodwin RM (1951) The nonlinear accelerator and the persistence of business cycles. Econometrica 19(1):1–17

Graham J, Leary MT, Roberts MR (2014) How does government borrowing affect corporate financing and investment? Technical report, National Bureau of Economic Research

Hicks JR (1950) A contribution to the theory of the trade cycle. The Clarendon Press, Oxford

Hommes CH (1993) Periodic, almost periodic and chaotic behaviour in hicks’ non-linear trade cycle model. Econ Lett 41(4):391–397

Hommes CH (1995) A reconsideration of hicks’ non-linear trade cycle model. Struct Chang Econ Dyn 6(4):435–459

Kostarakos I, Kotsios S (2017) Feedback policy rules for government spending: an algorithmic approach. J Econ Struct 6(1):5

Kostarakos I, Kotsios S (2018) Fiscal policy design in Greece in the aftermath of the crisis: an algorithmic approach. Comput Econ 51(4):893–911

Kotsios S, Leventidis J (2004) A feedback policy for a modified Samuelson-Hicks model. Int J Syst Sci 35(6):331–341

Kumar M, Woo J (2010) Public debt and growth, IMF working papers, pp. 1–47.

Puu T (2007) The hicksian trade cycle with floor and ceiling dependent on capital stock. J Econ Dyn Control 31(2):575–592

Puu T, Gardini L, Sushko I (2005) A hicksian multiplier-accelerator model with floor determined by capital stock. J Econ Behav Organ 56(3):331–348

Reinhart CM, Rogoff KS (2010) Growth in a time of debt. Am Econ Rev 100(2):573–578

Reinhart CM, Reinhart VR, Rogoff KS (2012) Public debt overhangs: advanced-economy episodes since 1800. J Econ Perspect 26(3):69–86

Romer, C. (2011). What do we know about the effects of fiscal policy? Separating evidence from ideology, Speech at Hamilton College, November 7, 2012

Romer C (2012) Fiscal policy in the crisis: lessons and policy implications, IMF Fiscal Forum, April, Vol. 18, Citeseer

Salotti S, Trecroci C (2016) The impact of government debt, expenditure and taxes on aggregate investment and productivity growth. Economica 83(330):356–384

Samuelson PA (1939) Interactions between the multiplier analysis and the principle of acceleration. Rev Econ Stat 21(2):75–78

Sushko I, Gardini L, Puu T (2010) Regular and chaotic growth in a hicksian floor/ceiling model. J Econ Behav Organ 75(1):77–94

Westerhoff FH (2006a) Business cycles, heuristic expectation formation, and contracyclical policies. J Public Econ Theory 8(5):821–838

Westerhoff FH (2006b) Nonlinear expectation formation, endogenous business cycles and stylized facts. Stud Nonlinear Dyn Econ. https://doi.org/10.2202/1558-3708.1324

Westerhoff FH (2006c) Samuelson’s multiplier–accelerator model revisited. Appl Econ Lett 13(2):89–92

Acknowledgements

Not applicable.

Funding

No funding was received for this research. Not applicable.

Author information

Authors and Affiliations

Contributions

VS was the major contributor in writing this manuscript. SK substantively revised it. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This research does not involve human subjects, human material, or human data. Not applicable.

Consent for publication

This manuscript does not include details, images, or videos relating to individual participants. Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Proof of Theorem 3.1.1.

Let at the time instant t = k the policy maker wants to achieve the target (Y∗k+1, B∗k+1). We shift the system (4)–(5) by 1 delay, we set (Yk+1, Bk+1) = (Y∗k+1, B∗k+1) and we get:

The unknown elements are (G∗k+1, τ∗k). The above system can be written in matrix form as follows:

Since \({\text{Det}}\left[ {\begin{array}{*{20}c} 1 & { - s_{1} Y_{k} } \\ 1 & { - Y_{k} } \\ \end{array} } \right] \ne 0\), because 0 < s1 < 1, then there is a unique solution for (G∗k+1, τ∗k) for every t = k. The solution is:

The efficiency of the control method is proven by substituting the above solution (G∗k+1, τ∗k) into the system (4)−(5), and shifted it by one. We get (Yk+1, Bk+1) = (Y∗k+1, B∗k+1). □

Appendix B

Proof of Theorem 3.2.1. and 3.3.1.

Consolidation, as defined in Sect. 3, can be interpreted for Case 1 as d1 > 0 and d1 > d2 and for Case 2 as d1 > 0 and d1 > r. This definition has the following consequences for Eq. (8) and (12):

1. The homogeneous part of Eqs. (8) and (12) can be written in state-space form as follows:

where \(T_{t} = \left[ {\begin{array}{*{20}c} {\tau _{t} } \\ {\tau _{{t - 1}} } \\ \end{array} } \right],T_{{t - 1}} = \left[ {\begin{array}{*{20}c} {\tau _{{t - 1}} } \\ {\tau _{{t - 2}} } \\ \end{array} } \right],C = \left[ {\begin{array}{*{20}c} {\frac{{s_{2} }}{{(1 - s_{1} )(1 + d_{1} )}}} & {\frac{{s_{3} }}{{(1 - s_{1} )(1 + d_{1} )^{2} }}} \\ 1 & 0 \\ \end{array} } \right]\).

Both terms \(\frac{{s_{2} }}{{(1 - s_{1} )(1 + d_{1} )}}\) and \(\frac{{s_{3} }}{{(1 - s_{1} )(1 + d_{1} )^{2} }}\) are positive and, according to Gershgorin Circle TheoremFootnote 7, if their sum is less than unity then the first eigenvalue of C has absolute value less than unity. The disc of the second eigenvalue has center the point 0 and radius \(\frac{{s_{3} }}{{(1 - s_{1} )(1 + d_{1} )^{2} }}\), which is less than unity. Thus, if \(\frac{{s_{2} }}{{(1 - s_{1} )(1 + d_{1} )}} + \frac{{s_{3} }}{{(1 - s_{1} )(1 + d_{1} )^{2} }} < 1\) then the tax rate is asymptotically stable. The above inequality always holds if d1 > 0, as for the partial consumption coefficients it is valid that s1 + s2 + s3 < 1 ⇒ 1 − s1 > s2 + s3.

2. It is straightforward that, in order for the inputs P and Q to converge to a limit which is a real number, their time-variant part must converge to zero. This is valid if and only if d1 > d2 and d1 > r for Eq. (8) and (12), respectively. □

Appendix C

a (%) | s1 (%) | s2 (%) | s3 (%) | r (%) | d1 (%) | d2 (%) | d3 (%) | v | b0 (%) | Iaut (%) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Figure 1 | 0.3 | 90 | 5 | 4 | 5 | 4 | 3.5 | – | 0.2 | 7 | |

Figure 2 | 0.3 | 90 | 5 | 4 | 5 | 4 | 3.5 | – | 90 | 7 | |

Figure 3 | 90 | 5 | 4 | 5 | 4 | 3.5 | – | 0.25 | 90 | 7 | |

Figure 4 | 0.3 | 90 | 5 | 4 | 4.5 | 3 | – | 0.25 | 90 | 7 | |

Figure 5 | 0.3 | 90 | 5 | 4 | 5 | 3.5 | – | 0.25 | 90 | 7 | |

Figure 6 | 0.3 | 90 | 5 | 4 | 5 | 4 | – | 0.25 | 90 | 7 | |

Figure 7 | 90 | 5 | 4 | 5 | 1 | 0.2 | – | 0.25 | 90 | 7 | |

Figure 8 | 0.3 | 90 | 5 | 4 | 5 | 3.5 | – | 2 | 0.15 | 7 | |

Figure 9 | 0.3 | 90 | 5 | 4 | 5 | 3.5 | – | 1.5 | 90 | 7 | |

Figure 10 | 90 | 5 | 4 | 5 | 3.5 | – | 1.5 | 0.2 | 90 | 7 | |

Figure 11 | 0.3 | 90 | 5 | 4 | 3.5 | – | 2.5 | 0.25 | 90 | 7 | |

Figure 12 | 0.3 | 90 | 5 | 4 | 4 | – | 1.5 | 0.2 | 90 | 7 | |

Figure 13 | 0.3 | 90 | 5 | 4 | 4 | 3.5 | – | 0.2 | 90 | 7 | |

Figure 14 | 90 | 5 | 4 | 5 | 1 | – | 4 | 0.2 | 90 | 7 |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Spyrakis, V., Kotsios, S. Public debt dynamics: the interaction with national income and fiscal policy. Economic Structures 10, 8 (2021). https://doi.org/10.1186/s40008-021-00238-4

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40008-021-00238-4